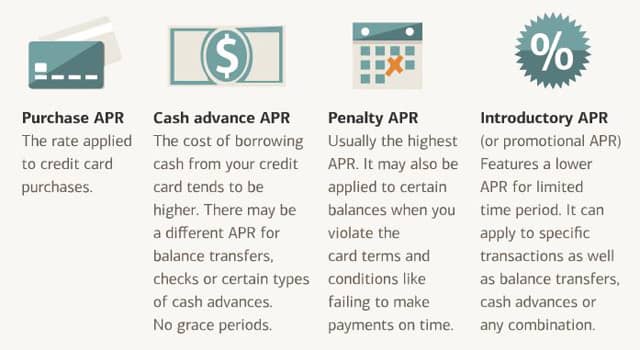

One question frequently asked is; "What is an APR on a bank card?". The standard concept of what makes a credit card varies from one company to an additional. Right here are a few of one of the most usual APR's and the answers you may need to recognize.

When a firm's terms state that a bank card will certainly have an APR, it means they will certainly charge you a percentage price. The best method to find out your APR is to multiply the APR by the amount of cash you are being charged.

Let's claim that your interest rate is 12% and you are being billed $100 per month. You will then require to accumulate your monthly repayment to discover the total quantity you will certainly be paying each month. This number will certainly include interest and also other charges that might be imposed on top of this quantity.

If you have a basic rates of interest, then you will only need to pay the rate of interest to the company on a monthly basis. Nonetheless, if you have a high rate of interest, then you will certainly be paying more than the mentioned rate of interest on a month-to-month basis.

Regardless, APR is a relative term when it pertains to bank card. Each company will have various concepts when it concerns the APR on their charge card.

The APR on a charge card is the distinction in between what is charged to you as a consumer and also what you pay the card firm. In order to understand the APR on a card, it is an excellent concept to talk to a representative and also ask the APR policy.

It is essential to understand that not all card business will use the very same APR. For that reason, it is critical that you research the rates of interest used by the card company prior to picking which card to utilize.

One point that is worth knowing is that the APR is computed after the truth. The extra generous the APR the a lot more you pay in interest as well as as a result the extra you will certainly owe the business.

If you have a long credit rating with the company as well as there are no recurring settlements on your card, after that you need to expect to pay really little in passion. On the various other hand, if you have a tendency to make large acquisitions, such as trips or bigger house renovations, you might pay much more in interest on a card with a high APR

. The most effective method to discover how the APR on a bank card functions is to contact a rep and request a copy of the terms. If the APR on the card is attractive, then you can anticipate to pay much less in interest consequently.

If you are searching for an APR card, there are some things to remember prior to deciding. Make certain that the APR is lower than what you would pay if you were to pay the whole amount each month.

One concern often asked is; "What is an APR on a credit report card?". If you have a lengthy credit score background with the firm and there are https://zero-apr.com/ no ongoing repayments on your card, then you ought to anticipate to pay very little in rate of interest. The ideal means to find out just how the APR on a credit rating card works is to speak to a rep as well as ask for a duplicate of the terms and conditions. If the APR on the card is appealing, after that you can anticipate to pay much less in rate of interest as an outcome.